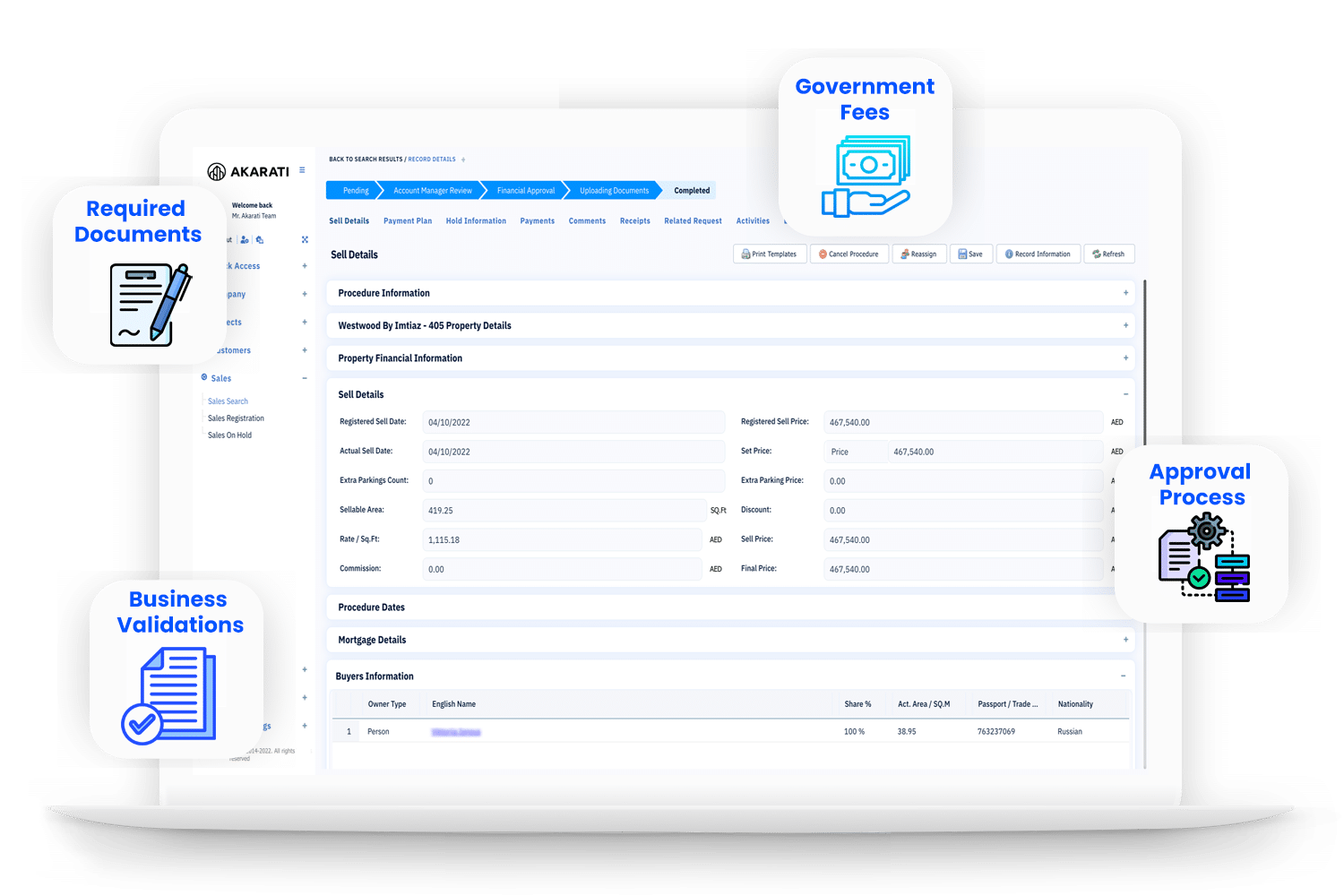

Enhancing Connectivity for Seamless Information Sharing between developers and brokers

In today’s rapidly evolving financial services industry, effective communication and seamless information sharing among developers, brokers, auditors, service centers, and customers have become crucial. The ability to connect and exchange information efficiently can significantly impact collaboration, decision-making processes, and overall customer service. This article explores the importance of connectivity in the financial services sector and examines key aspects that contribute to successful information sharing.

Data Integration and Interoperability

Financial services organizations often operate with diverse systems and platforms, making data integration and interoperability key challenges in information sharing. Efficient data integration enables the seamless flow of information across applications and systems, eliminating data silos and facilitating real-time decision-making.

Standardizing data formats and protocols simplifies data integration efforts. Adopting industry-wide data standards, such as Financial Information eXchange (FIX) protocol or ISO 20022, ensures consistency and compatibility across different systems. Well-defined data mappings and transformation processes help align data structures between disparate systems, facilitating smooth data exchange.

Integration middleware, such as enterprise service buses (ESBs) or integration platforms, provides a centralized hub for connecting and orchestrating interactions between various applications. These middleware solutions streamline the integration process, reduce complexity, and enable organizations to efficiently manage data flow across different components of the financial ecosystem.

Application integration via APIs allows developers to expose functionalities and data to external parties in a controlled manner. Organizations can leverage API management platforms to govern and monitor API usage, ensuring security and compliance while enabling seamless information sharing.

Collaboration and Workflow

Efficient collaboration and well-defined workflows are essential for successful information sharing among developers, brokers, auditors, service centers, and customers. Clear communication channels and effective collaboration tools are necessary to streamline interactions and ensure seamless information flow.

Collaboration platforms, such as project management tools, instant messaging applications, or shared document repositories, facilitate real-time communication and enable teams to collaborate efficiently. These platforms allow developers to share information, coordinate tasks, and seek feedback from stakeholders.

Well-defined processes and procedures for information sharing ensure consistency and accuracy. Organizations should establish clear guidelines on how developers share information with brokers, auditors, service centers, and customers. Documenting workflows, defining responsibilities, and implementing feedback mechanisms contribute to streamlined collaboration and enhanced productivity.

Case Studies and Best Practices

Examining real-world case studies and best practices provides valuable insights into successful implementations of connectivity in the financial services industry. These examples shed light on the challenges faced, solutions implemented, and the resulting benefits.

For instance, a brokerage firm might adopt an API-first strategy, exposing trading functionalities and market data through APIs to enable seamless integration with third-party applications. This approach enhances the accessibility of their services, enables clients to connect their trading platforms, and facilitates real-time information sharing.

Financial auditors might leverage secure document sharing platforms to exchange sensitive financial statements and reports with their clients. By implementing stringent access controls and encryption, they ensure data privacy while streamlining the auditing process.

Service centers can utilize centralized customer relationship management (CRM) platforms to consolidate customer information, allowing agents to access relevant data in real-time. This enhances the quality of customer support, enabling agents to provide personalized assistance based on up-to-date customer information.

Future Trends and Emerging Technologie

To stay ahead in the rapidly evolving financial services industry, it is essential to monitor emerging trends and technological advancements that shape the future of connectivity.

Cloud computing offers scalability, flexibility, and cost-efficiency, enabling organizations to leverage on-demand computing resources for connectivity and information sharing. Cloud-based integration platforms and microservices architectures facilitate seamless integration between systems and enable rapid innovation.

Internet of Things (IoT) devices, such as wearables or smart sensors, generate vast amounts of data that can enhance financial services. Connectivity with IoT devices allows for personalized services, risk assessment based on real-time data, and improved fraud detection.

Blockchain technology presents opportunities for secure and transparent transactions, reducing reliance on intermediaries. Smart contracts can automate and streamline complex financial processes, enhancing efficiency and trust in information sharing.

Artificial intelligence (AI) and big data analytics enable organizations to derive meaningful insights from vast volumes of data. Machine learning algorithms can analyze customer data, financial trends, and market behavior, providing valuable intelligence for decision-making and personalized services.

Technologies and Protocols

The establishment of robust connectivity relies on leveraging appropriate technologies and protocols. Various network protocols, application programming interfaces (APIs), messaging systems, and standardized data formats play a vital role in facilitating seamless communication and data exchange between stakeholders. Understanding these technologies enables organizations to build reliable and scalable connectivity solutions tailored to their specific needs.

Network protocols such as TCP/IP, HTTP, and HTTPS provide the foundation for data transmission over networks. These protocols ensure reliable delivery, data integrity, and secure communication between different systems. APIs enable standardized and structured data exchange between applications, allowing developers to securely share information with external parties. Messaging systems, such as message queues or publish-subscribe models, facilitate real-time data flow and enable asynchronous communication between different components of the financial ecosystem. The adoption of standardized data formats, like JSON or XML, ensures interoperability and ease of integration between systems.

Security and Privacy

In the financial services industry, the exchange of sensitive information requires stringent security measures to protect data confidentiality, integrity, and availability. Organizations must implement robust security and privacy practices to mitigate risks and ensure compliance with relevant regulations.

Encryption plays a critical role in securing data during transmission and storage. Secure Socket Layer (SSL) and Transport Layer Security (TLS) protocols provide secure communication channels by encrypting data between endpoints. Public-key infrastructure (PKI) enables the secure exchange of encryption keys and authentication certificates, further enhancing security.

Authentication mechanisms, such as two-factor authentication or biometric verification, verify the identities of users and ensure authorized access to systems and data. Access controls and role-based permissions restrict data access to authorized individuals, safeguarding sensitive information from unauthorized use.

Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) or the Health Insurance Portability and Accountability Act (HIPAA), is crucial for maintaining customer trust. Organizations must implement privacy policies, obtain consent for data processing, and establish secure data storage practices to comply with these regulations.

Welcome to our news letters

Akarati is One ERP platform to replace them all.

subscribe to our newsletters to know how all of your work can be done in one place.

.